Your credit score is a crucial aspect of your financial life, impacting everything from loan approvals to interest rates. Yet, understanding and improving this three-digit number can be challenging for many. Here’s a step-by-step guide to help you boost your credit score and maintain a healthy credit profile.

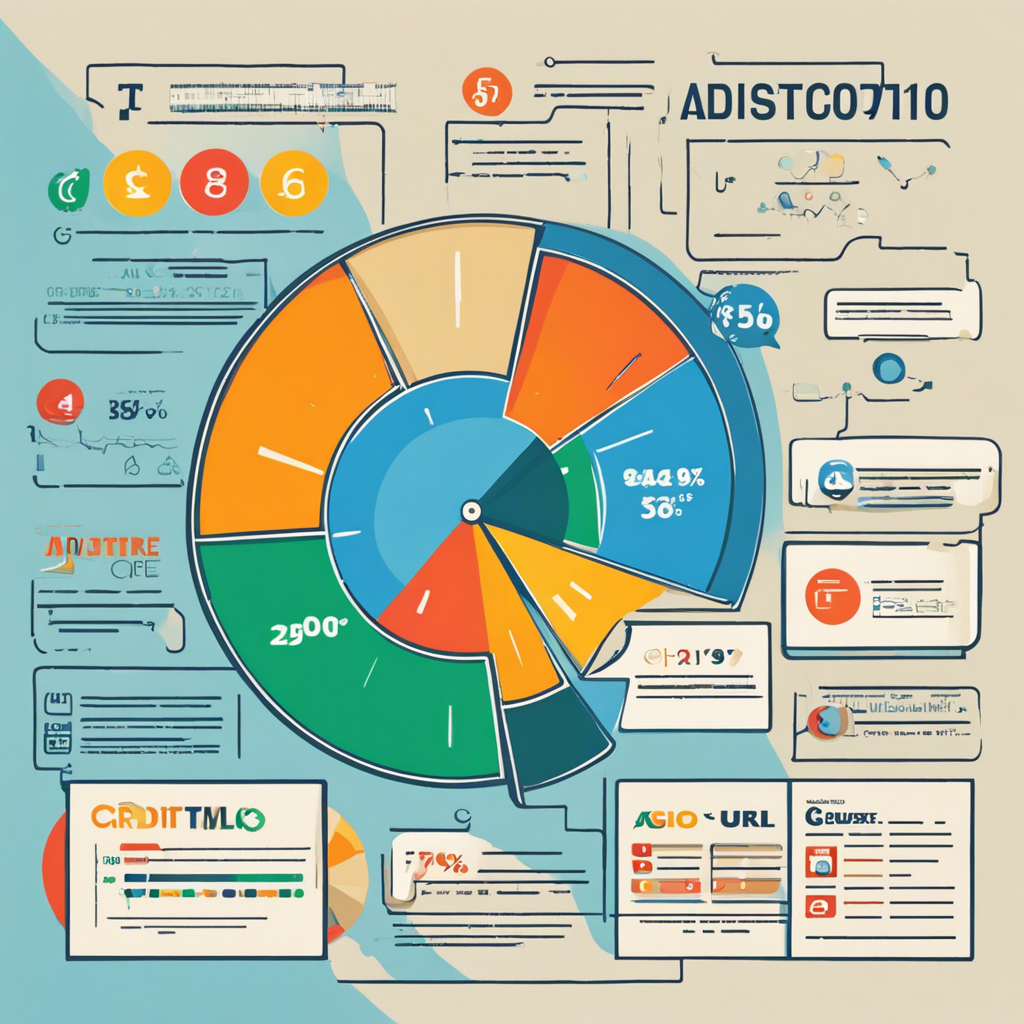

First, let’s break down the components that make up your credit score. Payment history is the most influential factor, accounting for 35% of your score. This includes on-time payments and any delinquencies. The next crucial factor is credit utilization, making up 30% of your score. This measures the amount of credit you’re using relative to your total available credit. Length of credit history (15%) considers the age of your oldest and newest accounts, while the mix of credit accounts (10%) looks at the variety of credit types, such as mortgages, auto loans, and credit cards. Finally, new credit (10%) reflects recent credit inquiries and new account openings.

To improve your score, start by consistently paying your bills on time. This builds a positive payment history, which is vital to lenders. Next, aim to keep your credit card balances low. Ideally, you should use less than 30% of your available credit limit. If you have multiple credit cards, spread your spending across them to maintain low balances on each. Another strategy is to request a higher credit limit, which can instantly lower your overall credit utilization ratio. Just remember not to use the increased limit as an excuse to spend more.

The age of your credit accounts also matters. Lenders prefer to see a lengthy credit history, so think twice before closing old accounts, especially if they have a positive history. If you’re an authorized user on someone else’s account with a good history, this can also boost your score. Diversifying your credit mix can help, too. While you shouldn’t take on unnecessary debt, having different types of credit, such as installment loans and revolving credit, can demonstrate your ability to handle various credit responsibilities.